The Michigan minimum wage is a crucial topic that affects millions of workers and businesses in the state. It influences not only individual earnings but moreover the broader economy by determining how much removable income employees have and how businesses entrust their labor budgets. With ongoing discussions well-nigh inflation and living costs, Michigan’s wage laws are increasingly relevant than ever. This vendible explores the latest developments, current rates, projections, and the legal framework governing Michigan’s minimum wage.

Current Michigan Minimum Wage Rates

As of October 2024, Michigan’s minimum wage stands at $10.10 per hour. The wage structure is based on the Workforce Opportunity Wage Act, which establishes variegated minimum wage tiers for regular employees, tipped workers, and minors.

Categories of Minimum Wage in Michigan:

General Employees:

The standard minimum wage in Michigan for most workers is $10.10 per hour. Employers must pay this rate unless a worker falls under an exception or a variegated wage tier.

Tipped Workers:

Tipped employees, such as waitstaff and bartenders, receive a lower minimum wage of $3.84 per hour. However, with tips included, their total earnings must meet or exceed the standard $10.10 per hour.

Minors (Aged 16-17):

Workers under 18 years old can legally be paid a minimum wage of 85% of the state minimum wage, which currently amounts to $8.59 per hour.

Training Wage:

Michigan employers are unable to pay new employees under the age of 20 a training wage of $4.25 per hour for the first 90 days of employment. This is intended to incentivize hiring young or inexperienced workers.

Upcoming Changes and Projections

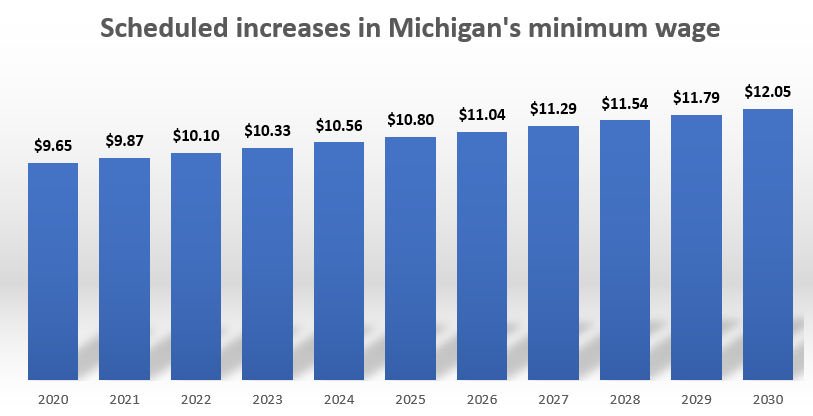

Michigan has a scheduled increase in its minimum wage to uncurl with inflation adjustments. In 2018, the state passed legislation to gradually increase the minimum wage to $12.05 per hour by 2030. However, the precise timeline is subject to transpiration based on economic conditions, unemployment rates, and inflation metrics.

In 2024, Michigan lawmakers moreover debated tying wage increases to the Consumer Price Index (CPI). If enacted, this welding would ensure wages rise proportionally with inflation, offering the largest purchasing power to workers. Many analysts predict Michigan’s minimum wage could exceed $13 per hour within the next five years under such policies.

Michigan Minimum Wage vs. Federal Minimum Wage

The federal minimum wage has remained at $7.25 per hour since 2009, creating disparities between states with increasingly progressive wage laws and those waxy to federal guidelines. Since Michigan’s wage exceeds the federal rate, workers in Michigan are legally entitled to the higher state wage.

For tipped employees, the federal tipped wage is $2.13 per hour, much lower than Michigan’s $3.84 rate. This discrepancy highlights Michigan’s relatively worker-friendly policies, expressly in industries dependent on gratuities.

Economic Impact of Michigan Minimum Wage

Impact on Workers

The minimum wage directly affects low-income workers, many of whom work in retail, hospitality, and service industries. Advocates oppose that raising the minimum wage ensures workers have wangle to vital necessities, like housing, food, and healthcare. Higher wages moreover midpoint increased removable income, boosting local businesses as consumer spending rises.

However, critics argue that warlike wage hikes may reduce job opportunities, expressly in small businesses with tight profit margins. Companies may resort to automating roles or limiting hours to manage rising labor costs.

Impact on Businesses

For businesses, the Michigan minimum wage mandates create challenges in managing labor expenses. Small businesses, in particular, often need to find creative solutions to remain profitable. Some companies reduce employee hours, while others shift financing to consumers through price increases. On the other hand, some merchantry owners see wage hikes as a way to vamp and retain skilled workers, reducing turnover and improving consumer service.

Michigan Minimum Wage and Living Wage Debate

While Michigan’s minimum wage helps many low-wage workers, advocates for a living wage oppose that the current rate is not sufficient for meeting the true forfeit of living. A living wage refers to the value an individual or family needs to imbricate housing, food, healthcare, transportation, and other essentials.

Studies suggest that a living wage in Michigan would be closer to $16-$18 per hour in urban areas like Detroit, where housing and transportation financing are higher. This discrepancy has fueled political movements to push for a higher minimum wage vastitude in the current trajectory.

Legal Framework and Compliance

Michigan employers must comply with state minimum wage laws to stave legal penalties. The Michigan Department of Labor and Economic Opportunity (LEO) oversees wage enforcement. Employers found violating wage laws can face:

- Fines and penalties for each infraction.

- Back pay requirements to recoup underpaid employees.

- Legal deportment or class-action lawsuits in severe cases.

Workers moreover have the right to report violations anonymously to the LEO. Both employees and employers should stay informed of well-nigh-wage laws to maintain compliance and solve disputes.

The Role of Minimum Wage in Reducing Poverty

The minimum wage is often seen as a tool to reduce poverty, expressly for families with children. Studies show that higher wages modernize health outcomes, increase wangle to education, and reduce reliance on public assistance programs. In Michigan, raising the minimum wage could reduce the financial undersong of state welfare programs, such as supplies assistance and housing vouchers, as increasingly families unzip self-sufficiency through the largest wages.

However, the extent to which minimum wage laws reduce poverty is still debated. Some oppose that wage increases vacated are insufficient without other social policies, such as affordable housing initiatives and childcare subsidies.

Public Opinion and Political Debate

Michigan’s minimum wage has wilted a political battleground, with advocates calling for faster wage increases and opponents warning well-nigh of the impact on small businesses. Labor unions, activists, and polity organizations oppose that a higher wage floor is essential to write income inequality, while some merchantry associations contend that wage hikes could lead to layoffs and inflation.

The debate over the minimum wage is likely to intensify during referendum cycles, as politicians often uncurl their platforms with wage-related policies. Voters in Michigan remain divided, with some prioritizing economic growth and others emphasizing worker rights and income equity.

Conclusion

The Michigan minimum wage is a ramified topic that touches on economics, labor rights, merchantry strategies, and public policy. While Michigan has made progress in raising wages, challenges remain in balancing the needs of workers and employers. As inflation and living financing protract to rise, the push for a living wage will likely shape future discussions. Staying informed of well-nigh wage laws and participating in local debates are essential for both employees and employers to navigate the evolving wage landscape in Michigan.

Michigan’s minimum wage not only affects paychecks but also influences economic health and polity well-being. Whether you are an employee striving to meet expenses or a merchantry owner managing labor costs, understanding the current and future wage laws is a hair-trigger for financial planning and success.